Market Analysis. February 03, 2025 Weekly Outlook.

Welcome to our market review where we will delve into current market dynamics and prepare our plan for the day.

What are we watching today ?

What are we watching today ?

- Assets to Watch: Today we’ll closely take a look at Bitcoin, Altcoins, DXY & SPX.

- Key Levels: Identifying and analyzing key levels that are crucial for these assets.

Market Outlook

Let’s start with a brief recap of the past few days. You’ve likely noticed it: an unprecedented liquidation cascade in the history of the crypto market, reportedly orchestrated—according to circulating social media information—jointly by Binance, Coinbase, and the market-making firm Wintermute. Naturally, this took place over the weekend, when market volumes are low. This event itself followed growing uncertainty and market anxiety over Trump’s trade hostilities, specifically the implementation of his notorious tariffs.

Monday was marked by a meeting between the Trump administration and Canadian/Mexican officials, which, as we anticipated a few hours prior, resulted in agreements—including the suspension of tariffs on the affected countries. The market reacted positively, with Bitcoin and the SPX fully recovering from their weekend declines. Gold, capitalizing on the overall risk sentiment, surged to a new all-time high (ATH), significantly outperforming other assets and currently flirting with $2,800 per ounce and beyond.

Surprise this morning. China responded preemptively to U.S. threats, demonstrating that, for Beijing, the best defense is a strong offense. This sent a chill through global markets, triggering a sharp and brutal sell-off. While not yet alarming, we’ll closely monitor the New York session and the Trump administration’s response.

And what about Europe? According to the new White House resident, they’re “out of line.” European leaders, however, have declared themselves ready to fight back. The perfect setting for trading the financial markets, isn’t it?

Trading Plan

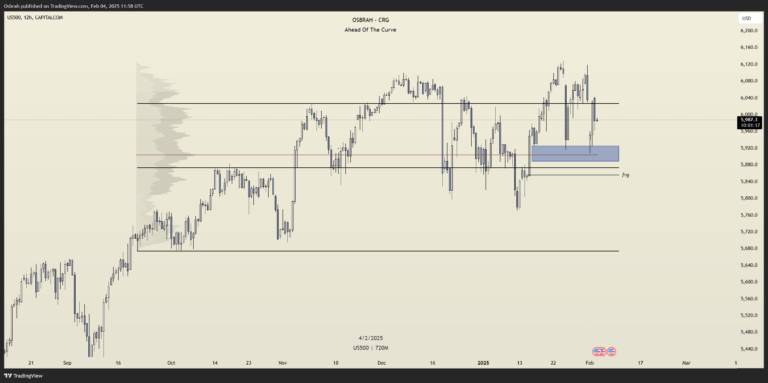

SPX

The SPX has now filled the upside gaps at 6100 and 6037. We’ll watch how Wall Street reacts when it steps in.

Nearest support: Around 5900

Current resistance: 6025

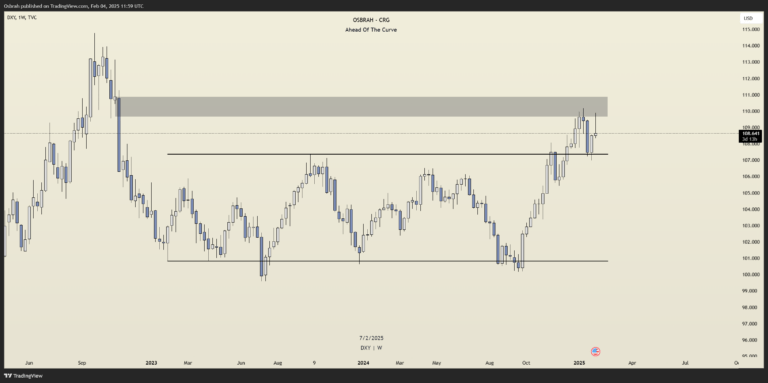

DXY

Keep an eye on the DXY, which continues to reject at the 110 resistance level but is not showing significant weakness either. It remains above 108 points and, more importantly, well above its major 107 support level.

Losing 107: A strong bullish signal for risk assets.

Breaking 110: Could send the market tumbling further.

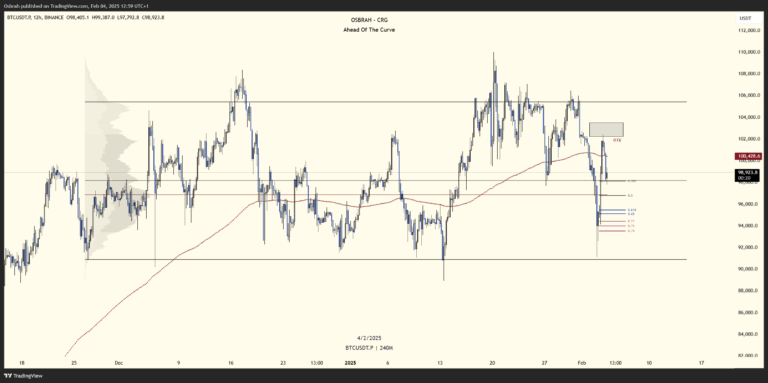

Bitcoin

While difficult to navigate, the range remains intact. The boundaries are roughly $91,000 (support) and $105,000 (resistance).

For today, we will first monitor:

$97,000 → First pivot level and potential support.

$93,500 → Coinciding with the Value Area Low of the range.

$105,000 → The main resistance to break, unchanged from before.

Lower timeframe resistance → The OTE around $102,000, which I mentioned yesterday.

Altcoins

Heavily weakened by the weekend’s events, altcoins remain the biggest losers of this cycle. The major liquidations over the weekend leave a critical question:

If the market fails to rebound, it would signal total disinterest from institutional and big players. Retail traders alone won’t be enough to drive prices higher—especially in an environment of elevated interest rates.

That said, we did see TOTAL 3 successfully hold its major support, despite a deep liquidity grab.

That’s it for today!

From the CFT team we wish you a happy week and good trades. Remember that none of the above is financial advice and the sole purpose is to give you insights about the current market conditions.

Thanks for reading.

Written by Osbrah From CryptoRise Group.

X: Osbrah