Crypto Market Analysis. Osbrah’s July 01-05 Weekly Outlook

Bitcoin Technical Analysis.

High Time Frame (HTF) Analysis

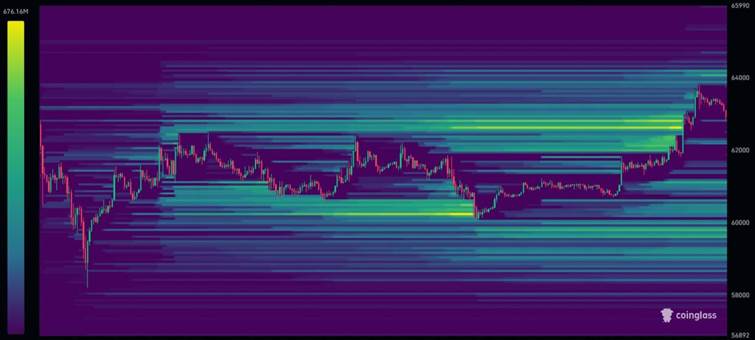

- Currently, we are around our marked Value Area Low and a key demand zone, indicating consolidation. This could mean we are either forming a bullish order block before a significant upward move or performing a bearish retest from below. The latter scenario might bring the price down to the $51,000 – $52,000 range. It would be prudent to take profits if you’re short or consider some spot buys/swing longs.

- Notably, we have lost the EMA100, which had been providing support for weeks. The EMA200 is around $58,000 and has not been retested since the significant run from $26,000 to $74,000. This level could serve as a strategic point for partial profit-taking if you’re shorting the market. Flipping this EMA would give more conviction from a buyer’s perspective.

- If we push higher and get some relief, our Point of Control (PoC) remains at our previous key level of $67,000. This area was crucial to hold during the lower time frame (LTF) uptrend.

In my assessment, the HTF outlook remains bearish unless we see a strong reclaim of the $62,000 – $62,500 area on the daily chart. I would maintain a defensive stance until then.

Low Time Frame (LTF) Analysis

- The technical analysis on the H4 chart is intriguing. We swept the lows around $59,000, reclaimed those levels, and pushed up to respect the golden pocket at $60,000. Currently, we’re above the Value Area Low, at $60,600 in our range volume profile.

- The EMA H4 trend has been strongly bearish, with BTC encountering significant resistance at each retest. Today’s push broke through this resistance, and the trend EMAs are about to cross bullishly. Note that this is a neutral analysis and coincides with a Sunday evening follow-up; clearer signals are expected on Monday.

- In the event of a push from current levels, I anticipate two ideal zones for risk-off moves: between $64,200 and $64,700. This range marks the start of the sell-off, a strong bearish order block, and contains our PoC and H4 EMA200.

- Presently, no immediate action is required. The price is slightly below the $62,500 low-time frame resistance and above the $59,700 – $60,000 support. The former can offer good short trade opportunities for scalping, while the latter should be considered a solid level for long positions, with clear invalidation below $59,000.

From my perspective, the LTF looks more favorable than the HTF, and I would lean towards scalp longs around $60,000 until support is broken.

Liquidity Levels

Comments

The new week promises to be interesting and exciting with several key events:

- U.S. PMI: Traditional markets will react to the figures, and the crypto market is likely to follow, with manufacturing data on Monday and services data on Thursday.

- Jerome Powell’s Speech: The Federal Reserve Chairman will speak in Sintra on Tuesday, following Christine Lagarde, President of the ECB. Expect volatility based on Powell’s tone—whether hawkish or dovish.

- Unemployment Claims & NFP: Expect strong volatility towards the end of the week.

In the crypto space, this is also a crucial week: - The launch date for the ETH spot ETF is expected before July 4, according to Bloomberg. SEC Chairman Gary Gensler indicated that the process is going smoothly, which might drive speculative upward movement until an official announcement.

- Conversely, the German government might continue its significant BTC selling, which could increase pressure on the crypto market.

Ethereum Technical Analysis

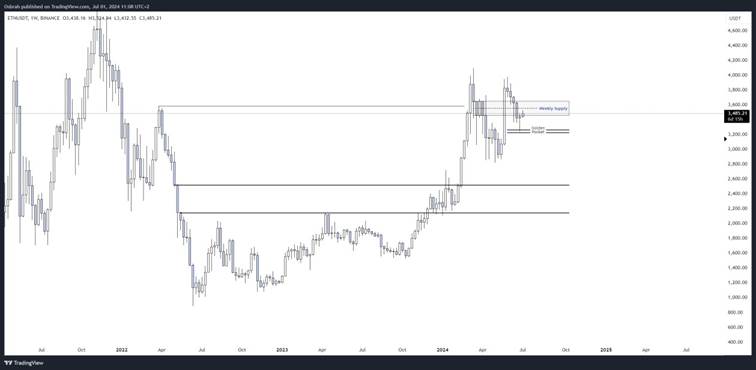

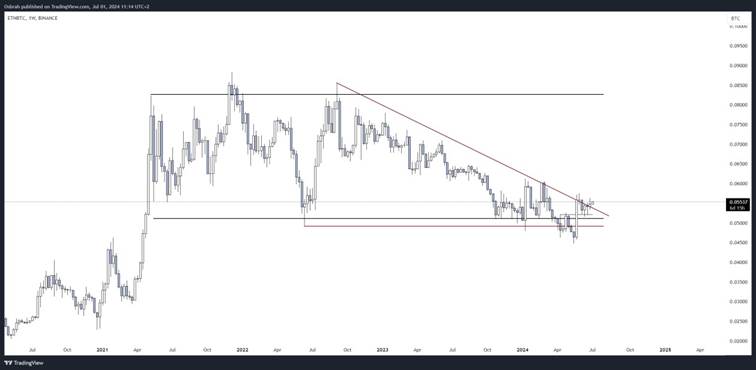

High Time Frame (Weekly)

- The weekly chart presents a mixed outlook. We bounced perfectly on the golden pocket, at $3,250 and are currently printing a large doji. However, we remain below the previous supply level, and conditions don’t look promising below the $3,500 area.

- My most bearish target, for now, is at the bottom of the weekly Fair Value Gap (FVG), around $3,100. This level also marks the beginning of the ETF-related impulsive move.

- If we lose this level and trend below $3,000, the price could potentially drop as low as $2,550, according to the levels on the attached chart.

- Indeed, reclaiming $3,500 could lead to a push towards at least $3,650.

Low Time Frame

- Similar to BTC, the LTF chart for ETH appears more favorable. We have flipped the EMA H1 trend as well as the Point of Control (PoC) after sweeping the lows. On the H4 chart, managed to break through the trend EMAs.

- Currently, the price though is encountering resistance around $3,500, previous key support level. That is the most significant resistance zone, which includes mid-range, EMA200 H4 and supply zone.

Comments

As mentioned earlier, ETH is the primary focus, especially with the impending ETF news. Despite the poor performance of altcoins thus far, ETH remains my strongest conviction play for capitalizing on a potential strong upward move fueled by this news. The ETH/BTC pair also looks relatively strong and stable. I am maintaining a long position taken previously, after having taken some partial profits at $3,500.

TOTAL 3 Analysis

Despite the seemingly positive appearance of the chart, the general outlook for altcoins remains bleak, particularly for leverage trading. Recent price actions and drops reinforce this view. Here are some key points:

- The current support at $570 billion is holding, supported by the golden pocket and the mid-range.

- As long as this support shows a positive reaction, it’s a favorable zone for accumulating spot positions. It’s still too risky for leverage unless strict risk management.

- The usual scenario applies: maintaining support here could lead to a push if BTC Dominance weakens. Conversely, losing this support could result in a significant drop, with the next support potentially at the EMA 200, around $500 billion. The most bearish target would be in the $295 billion – $300 billion range of capitalization. Yes that’s the bottom of our range.

Comments

In simple terms, many altcoins are currently well discounted, presenting good opportunities for long-term holds according to the TOTAL3 chart. However, recent sessions have demonstrated that altcoins remain weak against BTC. Many altcoins retrace quickly after any pump, underscoring the need for strict risk management and discipline in leverage trading.

If some tips could be given; it would be to focus on the strongest altcoins and those fitting current narratives, such as AI and ETH related ones.

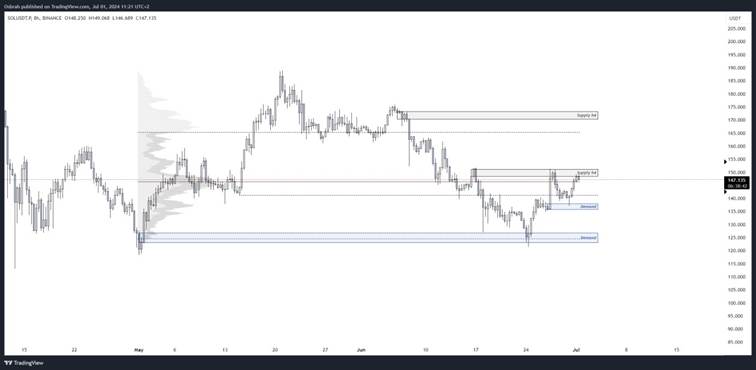

Solana Technical Analysis

Low Time Frame

Solana remains one of our favorite coins to pick, and there are several compelling reasons for this:

- Institutional Interest: Recent news highlights that some institutional investors are considering launching a Solana ETF/Trust, which is a significant catalyst for the coin.

- Technical Bounce: Solana recently bounced around the $120 level, shifting its structure from bearish to bullish on the smaller time frames.

- Recent Bounces: There was a recent, strong bounce from H4/H8 demand levels around $135, respecting the bullish structure shift.

- Key Resistance: The last major resistance before a potential move towards the $165 – $171 range is the $150 supply area, which is also a psychological level.

Comments

Given the potential for an ETF and the recent technical developments, Solana could see speculative upside despite the overall weakness in altcoins. Alongside Ethereum, Solana should be closely monitored in the coming days and weeks.

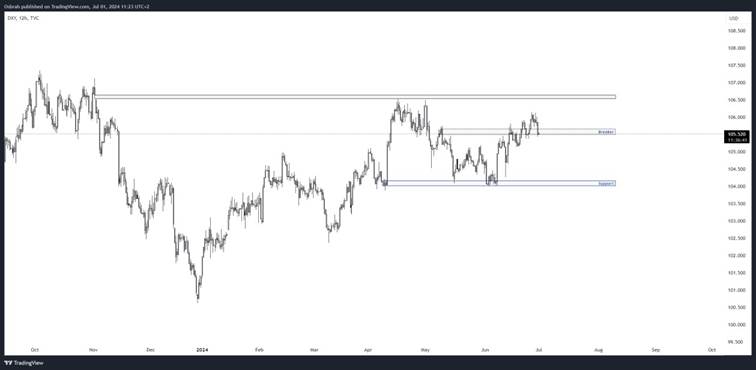

DXY Analysis

The current analysis of the DXY (US Dollar Index) indicates that the uptrend is being respected, maintaining its bullish momentum since breaking through the 105.5 resistance level. Here are the key points:

- Uptrend Intact: The DXY has sustained its uptrend since flipping the 105.5 resistance level. A move towards the 106+ level could happen soon and would be logical before any other significant changes.

- Technical Outlook: The structure remains bullish. If we see a break of the current breaker block, which is weakening, and then a shift in this structure, it could lead to a decline, with 104 being the target.

Comments

While the technical analysis is clear, it’s crucial to consider the upcoming economic news, which could influence the DXY significantly. Bad figures, especially related to inflation, could reinforce the current uptrend. The situation will be reassessed after today’s PMI. It’s important to monitor the structure closely, as a break could indicate a shift towards 106 or 104 level, depending of the numbers we get.

SPX Analysis

Last Friday’s closing session was quite eventful, with the SPX taking a hit after printing a new all-time high. Here are the key points of the current analysis:

• Current Contest: Bulls and bears are still contesting around the current Point of Control (PoC) at 5,275.

• Long Entry Plan: I am waiting for the bullish order block (OB) around 5,425 to be tapped before entering a long position. This plan will only be canceled if we receive unfavorable data figures.

Comments

If the SPX remains as strong as it has been recently, supported by robust figures, it is likely to print another new all-time high. The trend is currently very bullish, and I would not bet against it without clear signs of a reversal.

Conclusion

These analyses offer a comprehensive overview of various financial assets, ranging from cryptocurrencies to traditional market indices. They highlight current trends, key support and resistance levels, and potential catalysts to watch. It is important to note that this information is intended to assist in making informed decisions and should not be considered as investment advice. Financial markets carry risks, and it is essential to conduct due diligence and consult professional financial advisors before making any investment decisions.

Final

Thank you for reading this article. From the CFT team we wish you a happy week and good trades. This article should not be taken as an investment recommendation but in an educational and formative way.

Written by Osbrah from CryptoRise Group

X: Osbrah

X: CryptoRiseGroup