Crypto Market Analysis. Osbrah’s September 02-06 Weekly Outlook

Welcome to our market review where we will delve into current market dynamics and prepare our plan for the day.

What are we watching today ?

- Assets to Watch: Today we’ll closely take a look at Bitcoin, Ethereum, Total 3 & SPX.

- Key Levels: Identifying and analyzing key levels that are crucial for these assets.

- Today’s Economic News and Events: Bringing you the latest updates and economic events of the day that could impact the market and influence your trading.

Bitcoin

The week started on a difficult note for the market, and Bitcoin is no exception. The U.S. holiday on Monday gave it some breathing room, but risk-off sentiment quickly took over, exacerbated by weak PMI data.

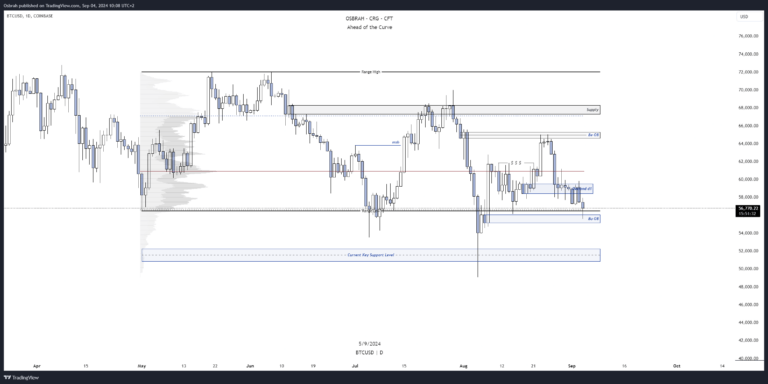

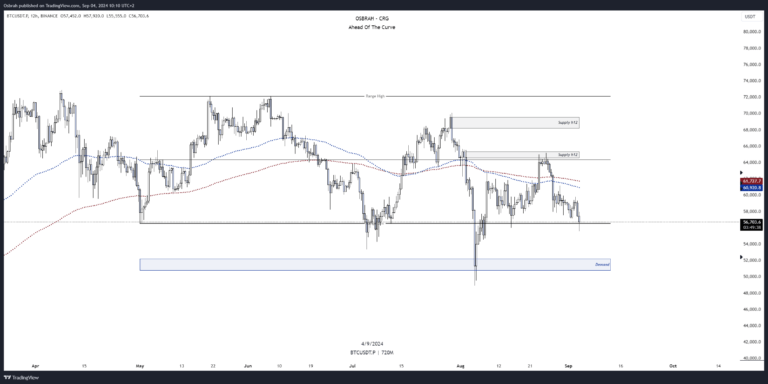

HTF Analysis

- Bitcoin remains within the range that has been respected thus far. Currently, the price sits at $56,700, a zone we discussed in the last market update.

- The bullish order block at $55,500 has been touched, providing a temporary pause for Bitcoin, allowing buyers to catch their breath. This zone is a logical entry point if you are looking to go long.

- However, if selling pressure resumes in the coming sessions and this support breaks, we are likely to revisit the crucial psychological and technical level of $50,000.

- Resistances remain unchanged: $61,700, $65,000, and $70,000 have not been tested, providing a sense of security for sellers.

LTF Analysis

- The LTF chart confirms the HTF trend: bearish, but at support and the lower range.

- A buy around $56,000 could be a great opportunity, with profit-taking targets around $61,700 – $62,000, then $65,000.

- These levels correspond to the H12 EMAs 100 and 200, as well as the mid-range where there is also an H12 supply zone.

- The upper range, which corresponds to a new ATH, seems far off.

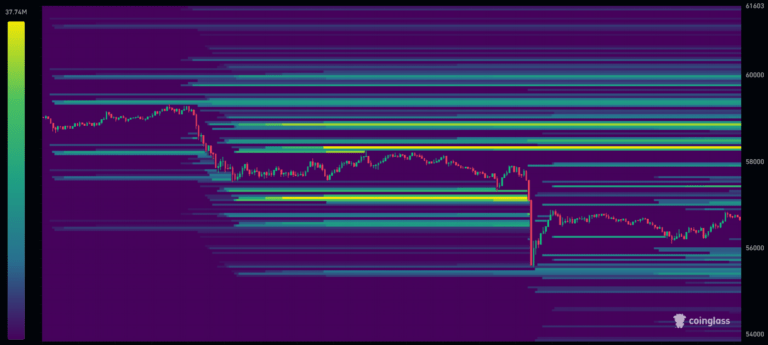

Liquidity Clusters

No surprises here—most liquidity, according to the Coinglass heatmap, has been swept to the South, leaving liquidity above $58,000 and beyond. If a bullish move occurs during the session, this level will be closely watched.

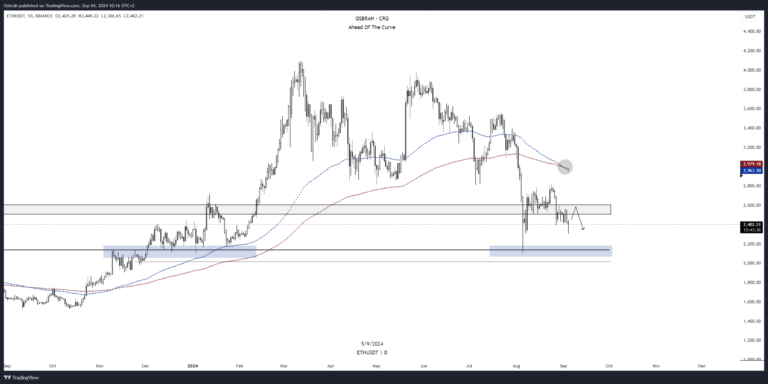

Ethereum

ETH remains relatively weak, unable to recover, and largely ignored by participants, who show little interest in Ethereum ETFs.

HTF Analysis

- $2,500 remains a key level, now acting as resistance. It’s a good area for selling. If flipped, the plan is to long towards $2,700 – $2,800. For now, there is no bullish signal.

- The bearish EMA cross reinforces that a bullish outlook is only possible if resistance is reclaimed.

- On LTF, the support level at $2,190 is crucial in case we drop lower.

ETHBTC

I rarely comment on ETHBTC, but the range is quite clear. The pain could continue down to 0.030. The low interest in ETH ETFs suggests that ETH won’t outperform BTC anytime soon.

TOTAL 3

Total 3 is following the path we discussed last week. Altcoins remain weak, as demonstrated overnight when BTC dropped. Most have broken their support levels and failed to hold ground. However, some are at interesting levels, and it could be worth scanning the market, which we will do in our live sessions.

- Patience is key if you’re looking to position yourself in altcoins. The $575 billion support has been lost, and the next support lies below the current level.

- The next critical support is around $480 billion. If this level breaks, we could see significant discounts across the market.

A cautious and well-thought-out DCA strategy is advisable, and if you are using leverage, ensure careful risk management. Focus on the most resilient altcoins, as always.

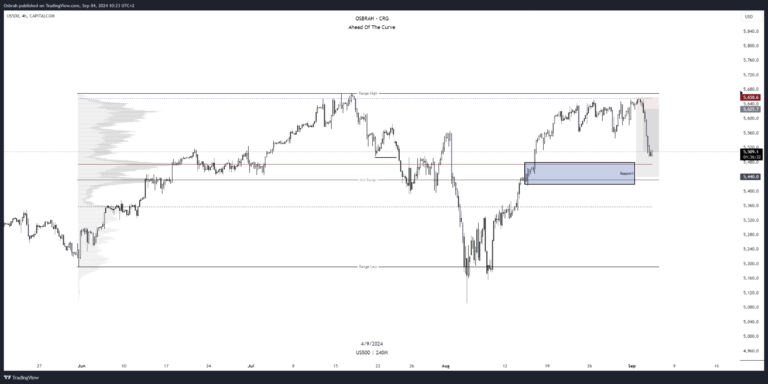

SPX

The SPX did not react favorably to the economic data, particularly the PMI, and this is reflected on the chart.

- Technically, we saw a rejection at the VaH around 5,655 points.

- The next support level is significantly lower and will need to be backed by both market participants and positive economic data: namely, the PoC and mid-range, around 5,450 points.

Economic Events

For the rest of the week, all eyes will be on employment data, and we will also be paying close attention to statements from certain FED officials. Their words could bring volatility to the market, so caution is advised, especially with the VIX already showing heightened activity.

That’s it for today!

Thank you for reading this article. From the CFT team we wish you a happy week and good trades.

Remember that none of the above is financial advice and the sole purpose is to give you insights about the current market conditions.

Thanks for reading.

Written by Osbrah From CryptoRise Group.

X: Osbrah