Crypto Market Analysis. Osbrah’s August 05-09 Weekly Outlook

Welcome to our market review where we will delve into current market dynamics and prepare our plan for the day.

What are we watching today ?

- Assets to Watch: Today we’ll closely take a look at Bitcoin, Ethereum, Total 3 & SPX.

- Key Levels: Identifying and analyzing key levels that are crucial for these assets.

- Today’s Economic News and Events: Bringing you the latest updates and economic events of the day that could impact the market and influence your trading.

Bitcoin

We start the week following a significant dump. After a week that favored the bulls, it’s now the bears who are celebrating. When will the baton be passed?

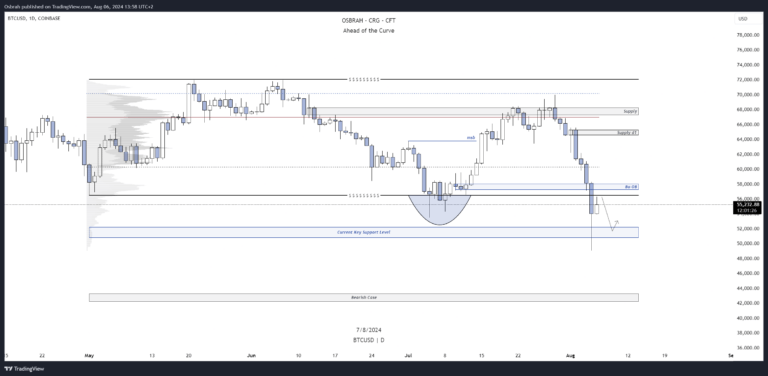

HTF Analysis

- Bitcoin has decisively broken through the lower range we established around $56,000, plunging further to reach $48,000. The symbolic $50,000 level briefly faltered.

- A few weeks ago, we discussed this potential scenario due to the order block hovering around $51,000. This zone must now hold and act as support.

- The trend remains bearish, but it is kept in check as long as the aforementioned support holds firm. The key level to reclaim for any potential recovery is still $56,000.

- The chart shows that after an attempt yesterday, the price has not yet managed to reclaim this level, so it’s essential to be prepared for a potential lower retest.

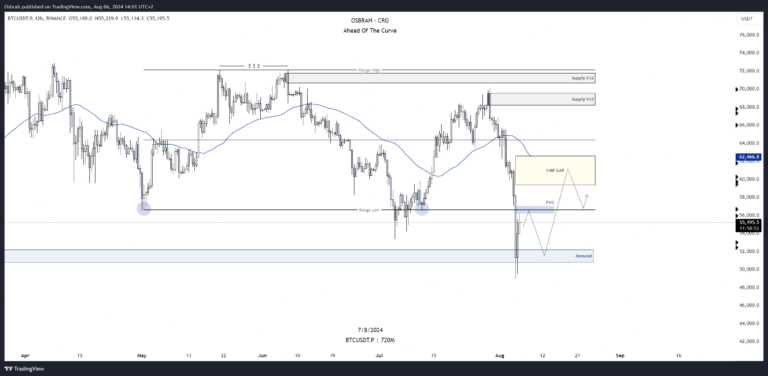

Intra-Day Analysis

- Aligned with the HTF plan, the key zones on the chart are much clearer, indicated by the blue circled areas.

- We see our current support around $51,000 and resistance around $56,000.

- Another interesting point is that the CME gap is now open to the north, ranging from approximately $59,000 to $62,500. This provides a well-established profit-taking zone if positioned long. At the upper boundary of this gap, we also find our daily EMA—confluence.

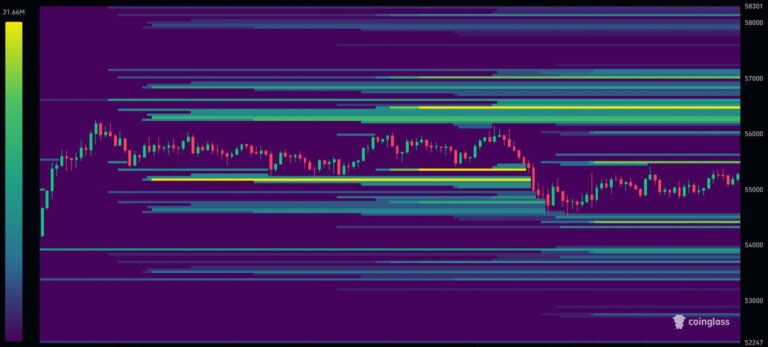

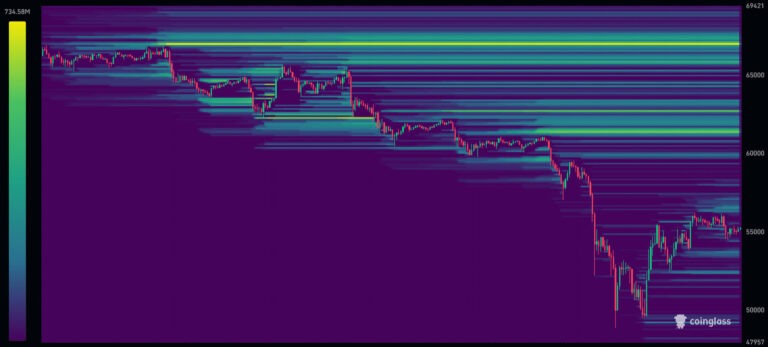

Liquidity Clusters

Intra-Day

Weekly

- After such a drop, it’s no surprise where the liquidity lies: in LTF, the majority resides above $56,500.

- In HTF, the main chunk is above $66,000.

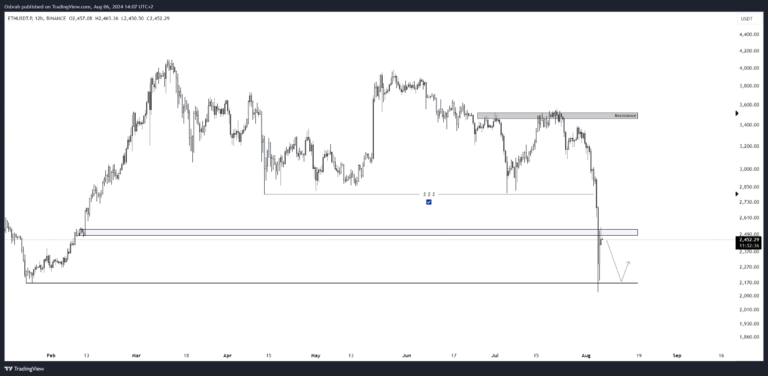

Ethereum

HTF Analysis

- Ethereum has suffered from underperforming compared to BTC and failed to hold its critical psychological $3,000 zone.

- We even flirted with the $2,000 level, as shown in the HTF chart, touching $2,100 briefly before returning to the $1,700 to $1,900 range.

- We also observe that the price struggles to reclaim $2,500, which should have acted as support during the dump.

- The outlook remains bearish unless this level is recovered. Buyers will be hoping that the $2,100 support continues to hold.

Intra-Day Analysis

- The levels here are also perfectly aligned with the HTF analysis and are quite logical. Additionally, this bottom is far more credible than the $2,800 level we had previously, given the liquidity grab and the lower points that have been taken.

- The current resistance zone for sellers is around $2,510 (blue zone). If this level is reclaimed, we could consider a potential upward recovery.

- The current support is at $2,170.

- We are far from it, but $3,500 remains the key level to break before even considering the possibility of a new ATH.

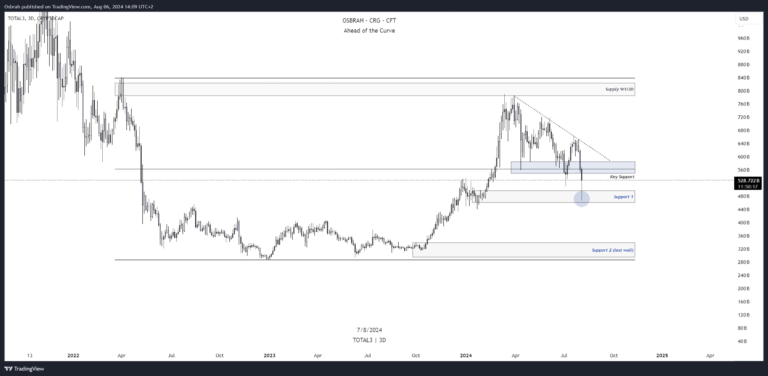

TOTAL 3

- The total market capitalization of altcoins has taken a significant hit and is struggling to recover. The market remains highly fragile on the alt side, and the few green numbers today shouldn’t divert your attention from this reality. Bitcoin remains the sole ruler, reigning as a total dictator.

- The current support acts as an intermediate line before the bottom of the range, which will be responsible for keeping the entire market alive.

- In light of this, it’s best to focus on the handful of altcoins showing some resilience (once again, Solana stands out) and avoid leverage.

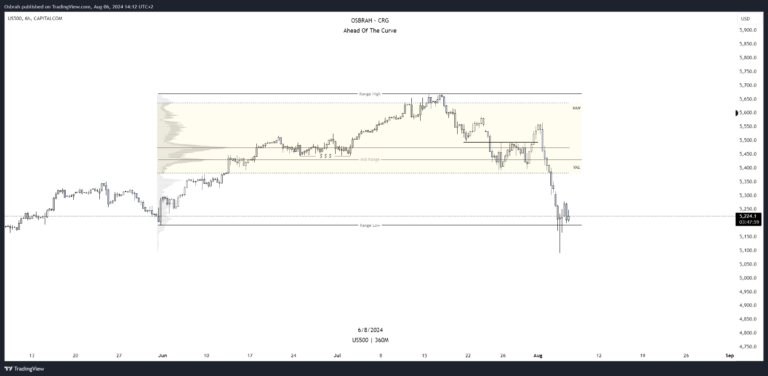

S&P500

In traditional finance, today’s session will be very interesting to follow, as the SP500 and the market, in general, seem to be regaining confidence, partly due to rumors of an emergency FED intervention in the coming days.

- From a technical perspective, it’s quite straightforward: we are above support, which must be maintained during the session.

- If this level is lost, expect the freefall to continue, with a potential visit to levels below $5,000.

Economic Events

This week, all eyes will be on employment data, which is currently the focus of both excitement and fear among investors and market participants. Some are once again raising concerns about a potential recession, which is compounded by the worsening geopolitical situation in the Middle East, as well as the evolved Monkey Pox surfacing again in Africa…

Expect increased volatility! Be cautious!

That’s it for today!

Thank you for reading this article. From the CFT team we wish you a happy week and good trades.

Remember that none of the above is financial advice and the sole purpose is to give you insights about the current market conditions.

Thanks for reading.

Written by Osbrah From CryptoRise Group.

X: Osbrah