Crypto Market Analysis. Osbrah’s July 08-12 Weekly Outlook

Bitcoin

Another painful session for Bitcoin enthusiasts as it broke through its last support lines, sinking into the lower $50,000 range. This was followed by a dreary weekend with pump-and-dump patterns. What can we expect from this new weekly session?

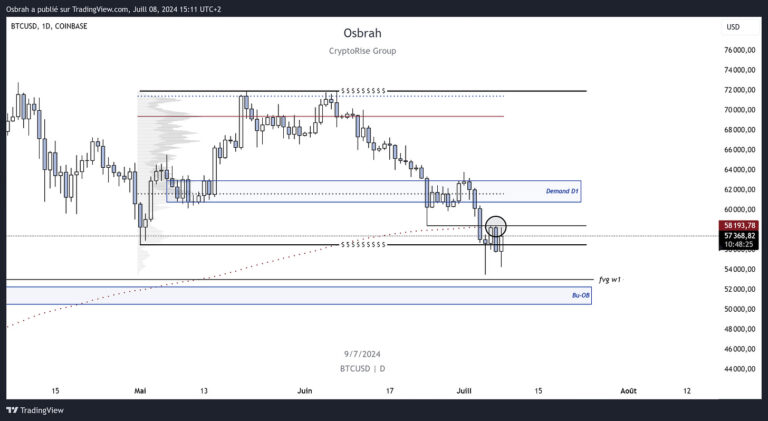

HTF Analysis

- As you can see, we have partially filled the weekly FVG and front-ran the demand zone around $51,000. This zone was highly anticipated, and it wouldn’t be surprising if we don’t reach it.

- The critical level to maintain is approximately above $56,500. Below this support, it would be prudent to wait for the demand zone mentioned earlier to avoid a “knife-catching” scenario.

- We have discussed support, now let’s address resistances: we lost the support of the daily EMA200 during this crash. This EMA now acts as a barrier to the price, as seen on the chart. The zone defended by sellers is around $58,300. A break above this resistance could lead to another attempt at $60,000.

- Additionally, it’s important to keep in mind that the German government continues its selling spree, maintaining pressure on Bitcoin’s price. These movements can be verified on the blockchain.

LTF Analysis

- The H4 view aligns with our HTF analysis; indeed, the resistance level is situated around $58,300.

- However, a reclaim of this level by buyers could propel us to $60,300, where we find the H4 EMA100.

- Caution is warranted as long as the $62,000 level is not breached, given the presence of the PoC and the EMA200. In summary, the situation remains challenging for buyers, with sellers maintaining their advantage.

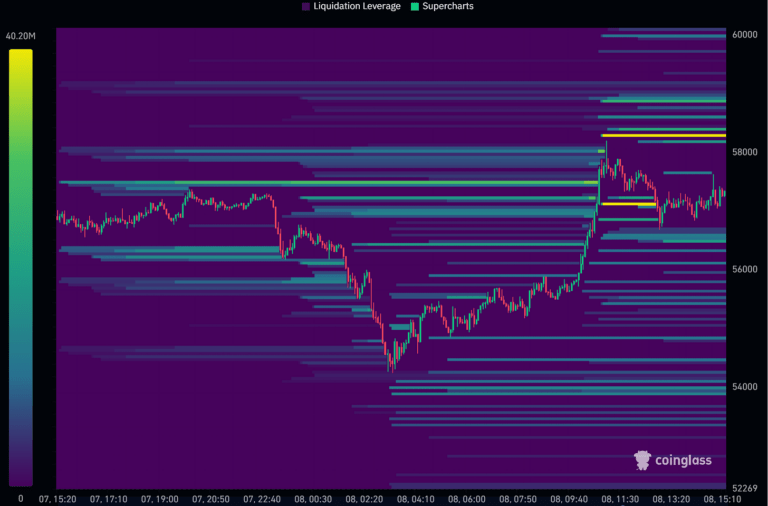

Liquidity Clusters

On the daily view, the liquidity zones indicated by Coinglass align with our analysis. The majority of liquidations would occur if we break the $58,300 resistance. Beyond that, a cascade effect could ensue.

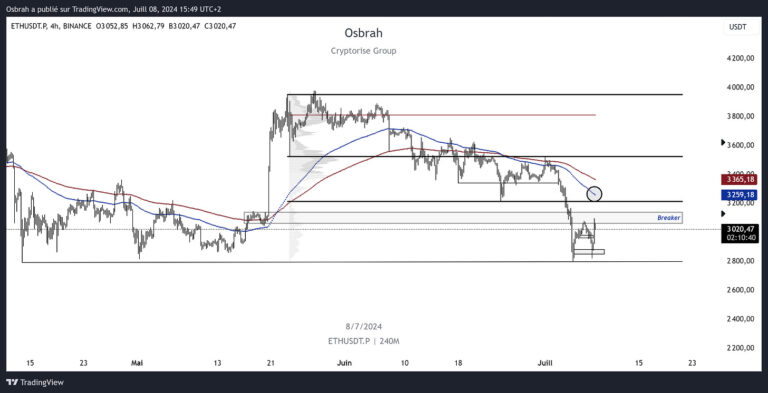

Ethereum

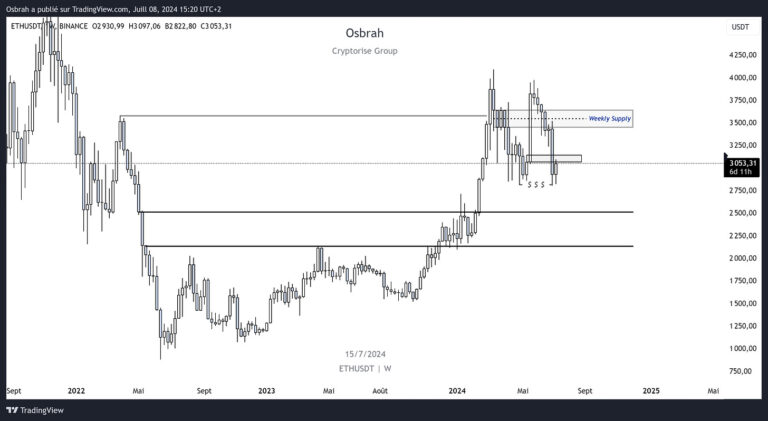

Ethereum has fallen below $3,000 despite the news regarding ETFs. As I write this, it is attempting to reclaim this psychological and reassuring level for buyers. Let’s dive into the technical analysis.

HTF Analysis

- Last week, we highlighted the risk if the price failed to reclaim the $3,500 level. The price quickly fell below $3,000 as anticipated.

- The current rebound is superficial, leaving behind equal lows that are concerning. A liquidity grab could bring the price down to around $2,550.

- For a renewed sense of optimism, a recovery to at least $3,200 is essential.

LTF Analysis

- On the H4 view, we have a well-defined support level around $2,800 to $2,900, with the potential formation of a W pattern.

- The level to break to maintain bullish momentum is around $3,100.

- The $3,200 to $3,250 range represents a solid resistance, considering the previous support established there and the EMA100 hovering above this level.

ETHBTC

Despite the ETF news, ETH struggles to assert itself against BTC. The price continues to consolidate within an approximate compression triangle, indicating a resolution may be imminent.

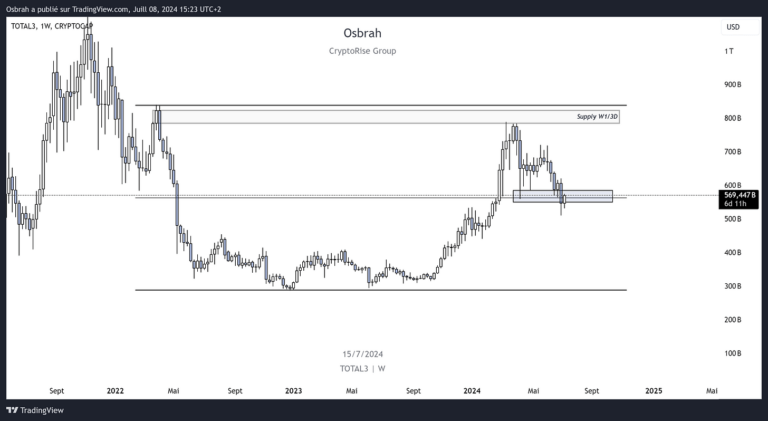

TOTAL 3

Following a major scare, the TOTAL3 market cap for altcoins is trying to give us some hope.

- Last week’s crash pushed the market cap below the $575 billion support level.

- The upward movement over the weekend helped maintain this support.

- It is imperative to hold this level to avoid another round of sell-offs in our favorite altcoins.

SPX

Comments for the SPX, the standout performer of recent months, which has been exceptionally strong. The chart clearly shows its current parabolic trend. We aim to ride this trend, considering the following levels for potential buying opportunities:

- The PoC and demand zone around 3,455 to 3,475 are the first interesting levels.

- If the price drops further, our interest will focus on the untested order block below the equal lows and the inducement zone, around 5,430.

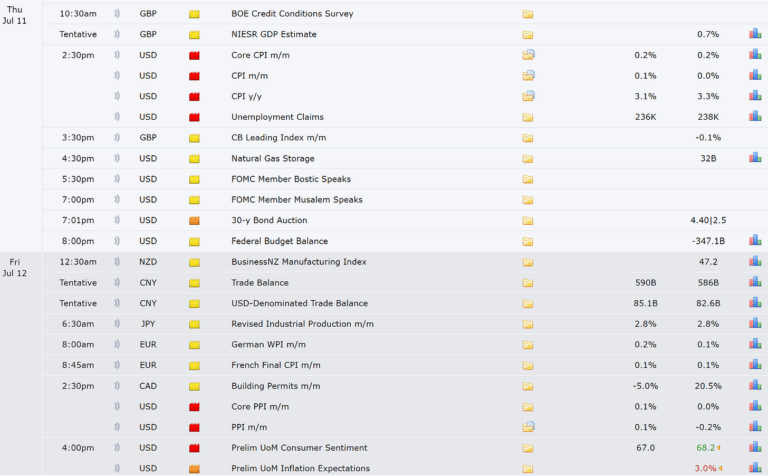

Economic Events

This week will be marked by significant US economic news, particularly the CPI and PPI reports. Stay vigilant as these figures will bring volatility and set the tone for the upcoming weeks.

Key Takeaways

Bitcoin

- Support Break: Dropped into lower $50,000 range, critical support at $56,500.

- Resistance: Daily EMA200 at $58,300; break above could reach $60,300.

- German Government Sales: Ongoing selling pressure on Bitcoin.

Ethereum

- Support Loss: Fell below $3,000; key support now $2,800 – $2,900.

- Resistance: Needs to reclaim $3,200 for optimism; risk of dropping to $2,550 still persists.

TOTAL3:

- Support Level: Holding above $575 billion; crucial to maintain to avoid further declines.

SPX:

- Strong Performance: Parabolic trend, key levels at 3,455 – 3,475 for buying opportunities.

Economic Events:

- Volatility Ahead: CPI and PPI reports this week will impact market trends.

Final

Thank you for reading this article. From the CFT team we wish you a happy week and good trades.

Remember that none of the above is financial advice and the sole purpose is to give you insights about the current market conditions.

Thanks for reading.

Written by Osbrah From CryptoRise Group.

X: Osbrah