Crypto Market Analysis. Osbrah’s July 15-19 Weekly Outlook

Bitcoin

What a weekend for the crypto market, especially for Bitcoin, which seems to be appreciating the almost certain victory of Trump in the US presidential elections following the weekend incident. After a clear scare, Bitcoin’s price surged, leaving pessimists and persistent sellers in disbelief.

HTF Analysis

- The May low was perfectly swept before being reclaimed, marking the current bottom around $53,000.

- Currently, the $56,500 level acts as crucial support and must hold.

- The daily EMA200 resistance was broken with strong momentum, indicating a resumption of the bullish trend.

- Maintaining above $60,000 would be a psychologically positive signal for buyers. Technically, a daily close above $63,200 would break the bearish trend and confirm a bullish signal.

- In case of a continued upward move, liquidity above the equal highs at $72,000 is visible on the chart.

- The bullish scenario would be invalidated with a close below $60,000.

LTF Analysis

- BTC has broken its resistance at $59,200 and the supply at $59,800.

- A retest of this zone in LTF would validate a breaker around $60,000, which aligns with the trend of the 4H EMAs.

- Resistance levels are around $64,000 and, crucially, $67,000. A break above $67,000 could lead to a move to at least $72,000, the upper range limit.

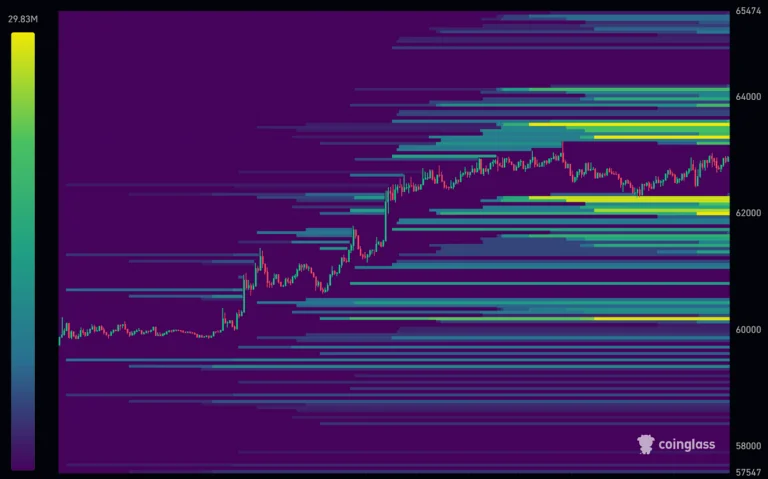

Liquidity Clusters

Liquidity is located above $63,000 and below $62,000. These zones will be targeted by buyers and sellers aiming to capture opposing liquidity.

Ethereum

Ethereum has regained strength, largely due to the anticipation of the ETF launch date announcement this week.

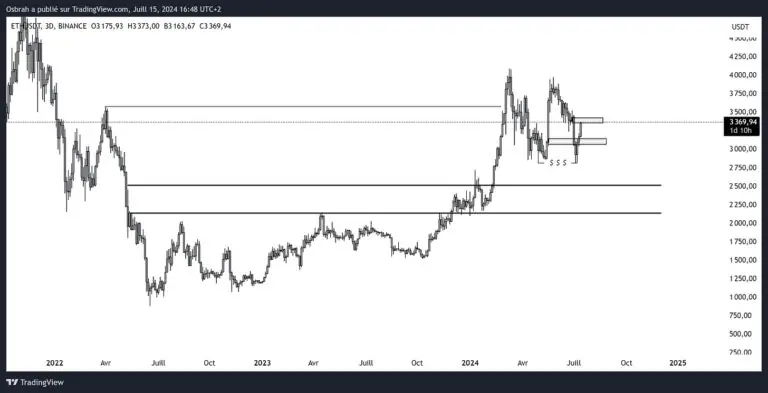

HTF Analysis

- ETH initially reclaimed the psychological level of $3,000 and has maintained above this zone, recovering $3,200.

- We are currently entering a turbulence zone, the 3-day supply zone, corresponding to $3,400 and extending to $3,500.

- If the bearish trend resumes and current supports are lost, the critical support to hold is around $2,500, where the 3-day EMA200 is also located.

LTF Analysis

- ETH has performed an “S/R flip,” turning previous resistance into support at $3,200.

- We are also above the bearish order block at $3,300, indicating buying strength and bullish momentum.

- On the 4H view, the next resistance level to be cautious of is $3,500, a significant S/R flip level.

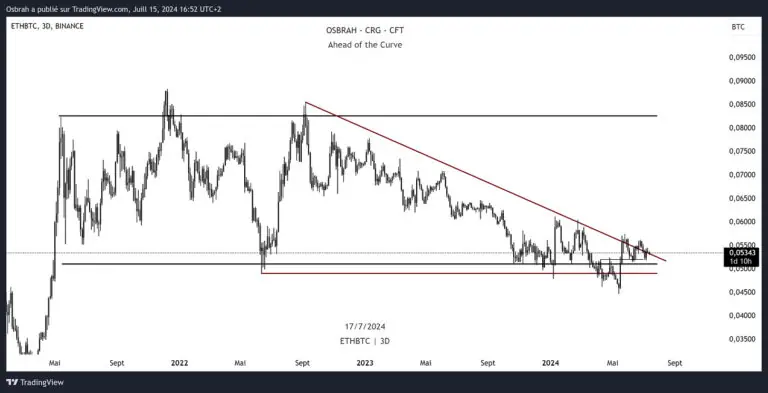

ETHBTC

Despite the ETF news, ETH struggles against BTC. The pair continues to consolidate within a compression triangle, and a breakout is expected with the ETF announcement. For now, BTC remains the market leader, setting the tone.

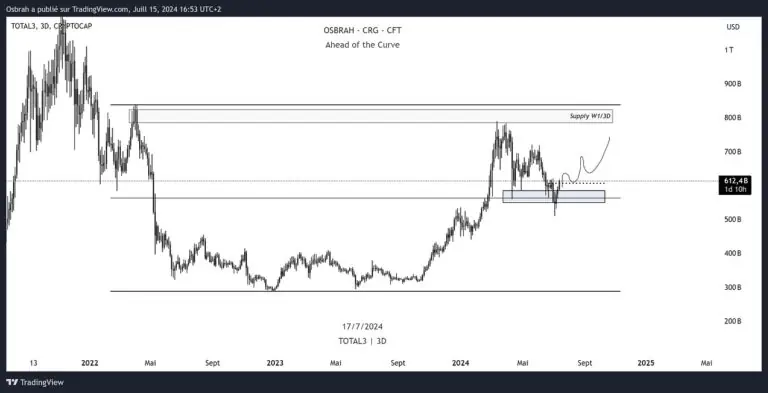

TOTAL 3

The market cap of altcoins excluding ETH and BTC shows promising signs of recovery:

- After sweeping below the $575 billion support, the market has rebounded, led by resilient alts like Solana and Link.

- Maintaining this key level is essential for a market rebound. The second condition for confirmation is breaking the supply zone at $615 billion, which could accelerate the market’s pace.

SPX

The SPX continues its exceptional performance, maintaining its strong bullish momentum. It is still advised against taking short positions. The most favorable level for re-entering the market is in the demand zone around 5,581.

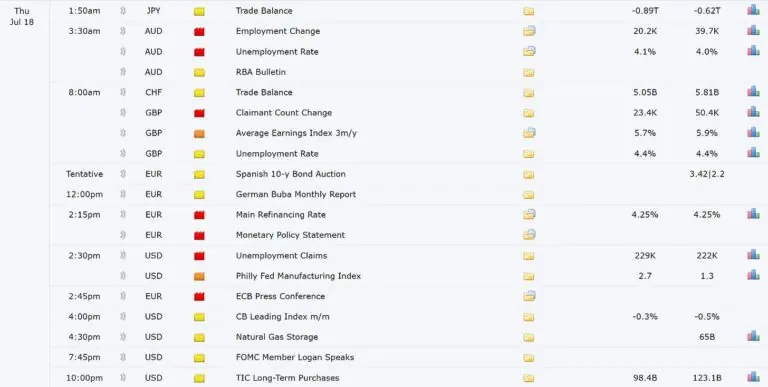

Economic Events

The key data to watch this week is the US jobless claims. An increase in claims would fuel the bullish trend, while a decrease could slow the momentum.

Key Takeaways

Bitcoin

- Support Reclaimed: May low swept and reclaimed at $53,000; current crucial support at $56,500.

- Resistance Broken: Daily EMA200 resistance at $58,300 broken; maintaining above $60,000 is key for bullish sentiment.

- Bullish Confirmation: Daily close above $63,200 confirms bullish trend; potential target at $72,000 if upward momentum continues.

- Downside Risk: Bullish scenario invalidated with a close below $60,000.

Ethereum

- Support Levels: Reclaimed $3,000 and maintained above $3,200; critical support at $2,500 (3-day EMA200).

- Resistance Zone: Entering turbulence zone between $3,400 and $3,500.

- Bullish Momentum: S/R flip at $3,200 and strength above $3,300 order block; next resistance at $3,500.

TOTAL3:

- Support Maintained: Market cap of altcoins holding above $575 billion after a sweep; recovery led by resilient alts.

- Resistance Target: Breaking supply zone at $615 billion could accelerate market recovery.

SPX:

- Strong Momentum: Continues exceptional performance; advised against short positions.

- Buying Opportunity: Favorable re-entry level around demand zone at 5,581.

Economic Events:

- US Jobless Claims: Key data this week; an increase supports bullish trend, while a decrease could slow momentum.

Final

Thank you for reading this article. From the CFT team we wish you a happy week and good trades.

Remember that none of the above is financial advice and the sole purpose is to give you insights about the current market conditions.

Thanks for reading.

Written by Osbrah From CryptoRise Group.

X: Osbrah