Crypto Market Analysis. Osbrah’s July 29-02 Weekly Outlook

Bitcoin

Bitcoin has started the week in a strong position for bullish enthusiasts. Currently flirting with $70,000, it is providing optimism for buyers at the expense of pessimists.

HTF Analysis

- Bitcoin continues to trade within a range and is approaching the upper bound around $72,000.

- The immediate obstacle is the value area high at $69,900 on the daily Coinbase chart.

- If there is a rejection and retracement, we should observe the reaction at the previous supply level. To maintain the current momentum, the price needs to find support between $67,500 and $68,200. This zone offers a buying opportunity before potentially revisiting lower levels discussed last week.

LTF Analysis

- The structure remains clearly bullish, with support and resistance zones being respected.

- Currently, it’s recommended to seek buying opportunities to follow the current trend.

- Key support zones are around $67,500. If this support fails, we have potential support at $64,000 (H4 EMA200) and the CME gap around $60,000.

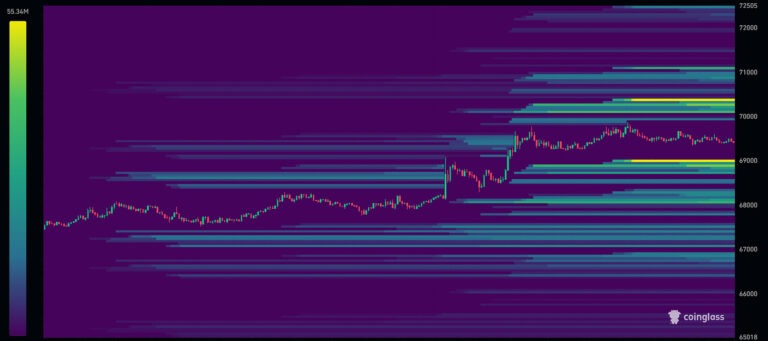

Liquidity Clusters

Liquidity to target for the next move is situated above $70,400 and below $69,000. Use this information to manage your risk and stop-loss positions effectively.

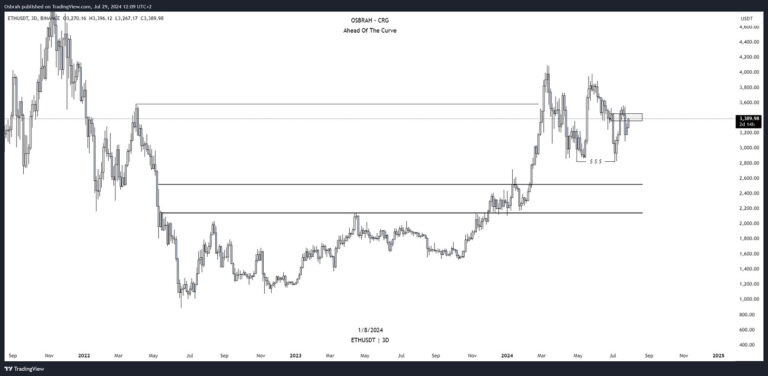

Ethereum

Is there finally some renewed energy for Ether? It has perfectly followed our plan, using the $3,200 support to propel itself, nearly matching Bitcoin’s performance.

HTF Analysis

- We stick to a winning strategy. ETH is testing the same resistance zone, $3,400 – $3,500.

- Exercise caution and avoid FOMO if you are not already positioned; consider taking profits or looking for selling positions around this zone.

- Above $3,500, the path is clear to reach the upper bound at $4,000.

LTF Analysis

- Technically, everything looks perfect. Ether retested its $3,200 support after a sweep and fill of the FVG indicated on the chart.

- We are back above our H4 EMAs 100, 200, and the daily EMA.

- A strong demand zone has been created at $3,270, but there’s also a lot of imbalance that could be filled.

- In case of a pronounced rejection, the $3,200 and $3,100 zones must hold. Failure to do so could expose the lows at $2,800, potentially leading to liquidity grabs below this level.

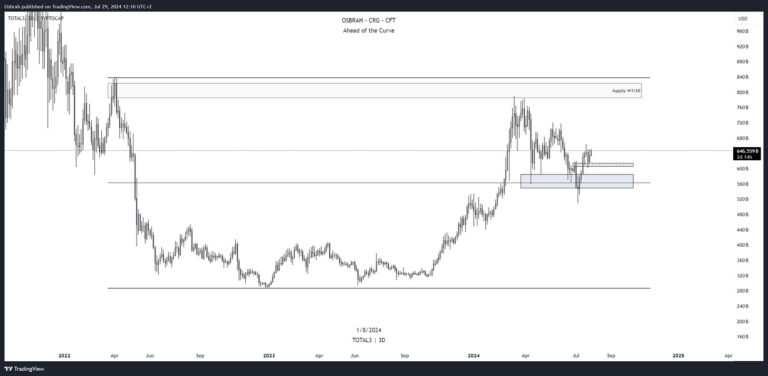

TOTAL 3

The altcoin market isn’t graphically catastrophic and reflects the same data points as last week. However, it is essential to note that the market’s upward movement is driven by a few robust cryptos, notably Solana, skewing the analysis.

Altcoins remain weak compared to Bitcoin’s performance. We hope for a rotation towards Ethereum and eventually to altcoins, providing relief for many holders and investors.

SPX

A quick point on traditional finance. The SPX has broken through several support levels, providing no respite for buyers. However, the current movement is noteworthy.

- The SPX swept a significant demand zone and the VAL at 5,400.

- After a fantastic push, it is attempting to change the structure and reclaim the 5,470 level, which held our PoC and previous demand acting as resistance.

- If this reversal is confirmed, we might fill the gap higher around 5,550.

- Caution is advised if support at 5,400 is lost, indicating a continuation of the bearish trend.

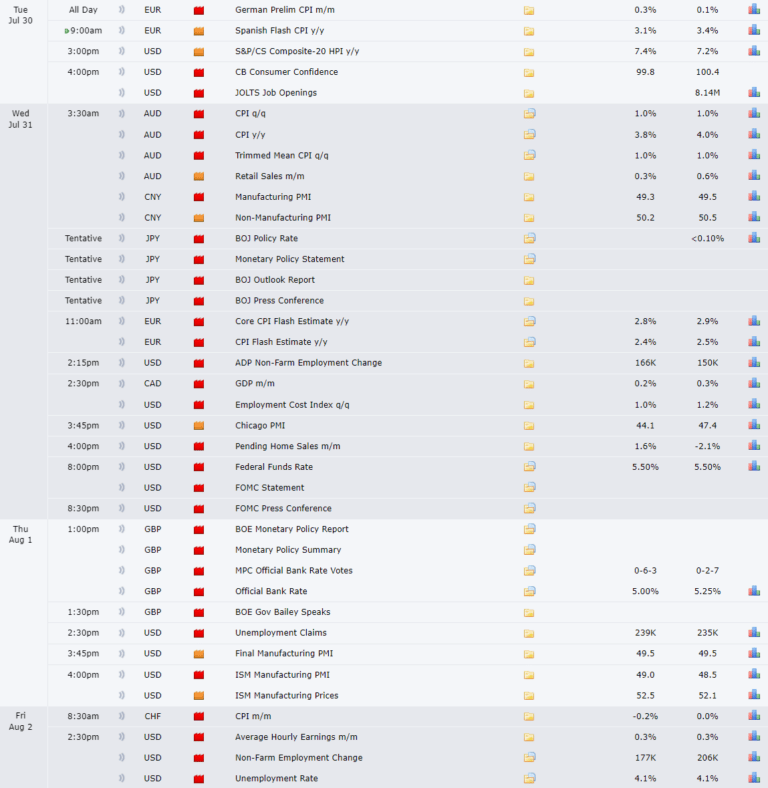

Economic Events

This week is busy with the notable FOMC meeting. The FED will indicate whether it maintains its rates, and Powell will provide further information on the committee’s current stance on the economic situation.

Expect increased volatility! Be cautious!

That’s it for today!

Thank you for reading this article. From the CFT team we wish you a happy week and good trades.

Remember that none of the above is financial advice and the sole purpose is to give you insights about the current market conditions.

Thanks for reading.

Written by Osbrah From CryptoRise Group.

X: Osbrah